Although the use of checks is less common, checks are still widely used in today’s digital world. Paper checks are an effective and inexpensive tool for moving money, but you probably don’t write a check every day (or maybe you’ve never written one).

Writing a check is easy. This article will show you exactly how to do it. Follow each step individually or use the example as shown in the article for your reference. The steps can be done in any order if the finished product does not miss any important information. This example goes from top to bottom so you can avoid skipping steps.

Table of Contents

- Know your Check:

- How to Write a check?

- What are the different types of checks?

- List of Different Types of Checks:

- What is a bank check?

- What is a payroll check?

- What are E-checks?

- What is a traveler’s check?

- What is a personal check?

- What is a money order?

- What is a certified check?

- What are cashier checks?

- What is a commercial check?

- What is a business check?

- What is a government check?

- What is a tax-refund check?

- What is an insurance check?

- What is an out-of-state check?

- Summary

- FAQs: Frequently Asked Questions

Know your Check:

How to find your Bank Routing Number?

It is a 9-digit no. printed in the bottom left corner of the check. The number is used to identify a financial institution responsible for the payment and ensures that funds go to the right place.

Account Number:

It is your bank account no., and you can find it adjacent to the bank routing no.

Check Number:

This number represents check no.

How to Write a check?

What are the 6 steps to writing a check?

Is this your first time writing a check or has it been a while? You may have questions like where to sign checks and how to write checks in cents and many more. So, here is the solution to all your questions.

Step 1: Mention the Date

Mention the date on the line at the top right-hand corner of the check. Mentioning the date is important as it will provide the date on which the check is written, and the expiry of the check will also depend on it.

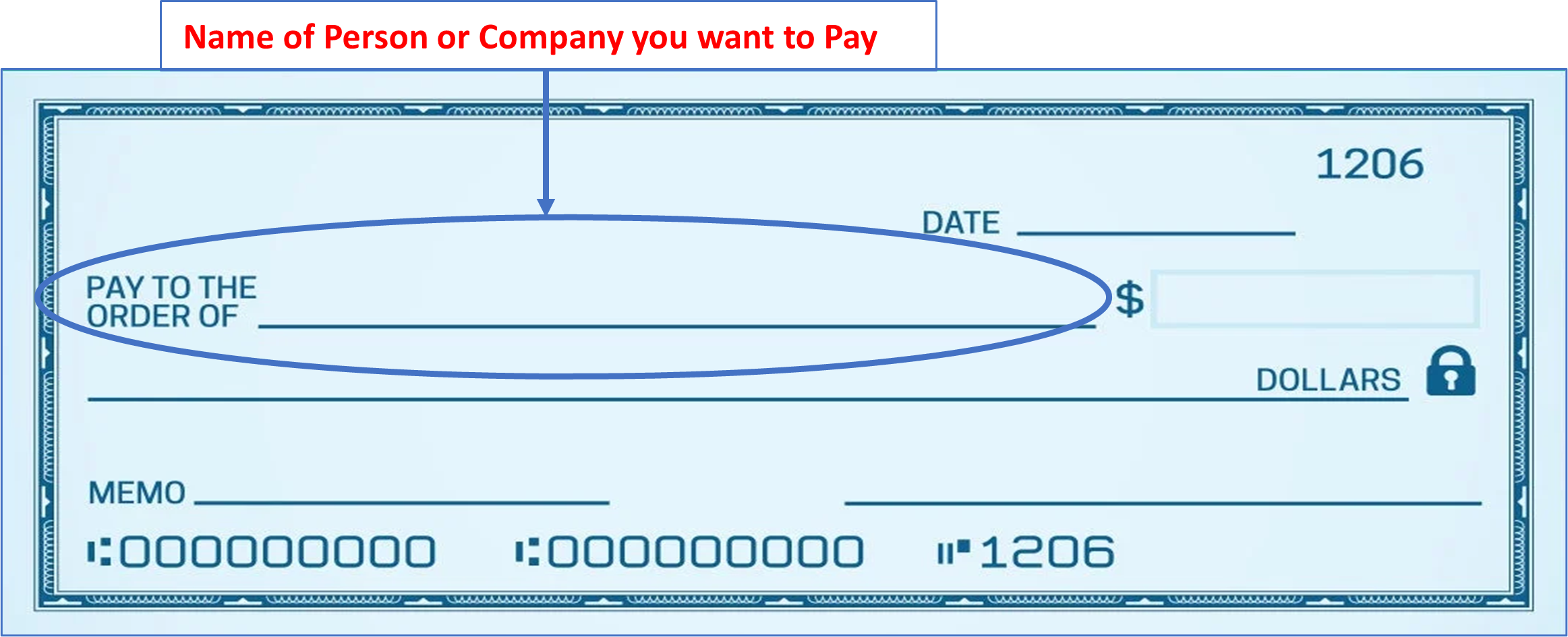

Step 2: Mention the name of the Payee

Write the name of the person or company you wish to pay for. If you don’t know the exact name of the person or organization, you can simply write “cash”. Be aware, however, that this can be dangerous if your check is lost or stolen. Anyone can cash or deposit a check for “cash”.

Step 3: Write the payment amount in numbers

There are two points to writing the amount to be paid on the check. First, you need to enter a numerical amount in the small box on the right (eg $160.45), and second, in words. Write this clearly so the ATM or bank can deduct the correct amount from your account.

Step 4: Write the payment amount in words

Write the amount in words that match the amount you wrote in the box. For example, if you pay $160.35, write 160 and 35/100. To write a check in cents, make sure the amount is greater than 100 cents. If the amount is a fraction, add “and 00/100” for clarity. Verbalizing the amount is important for the bank to process the check and verify the correct payment amount.

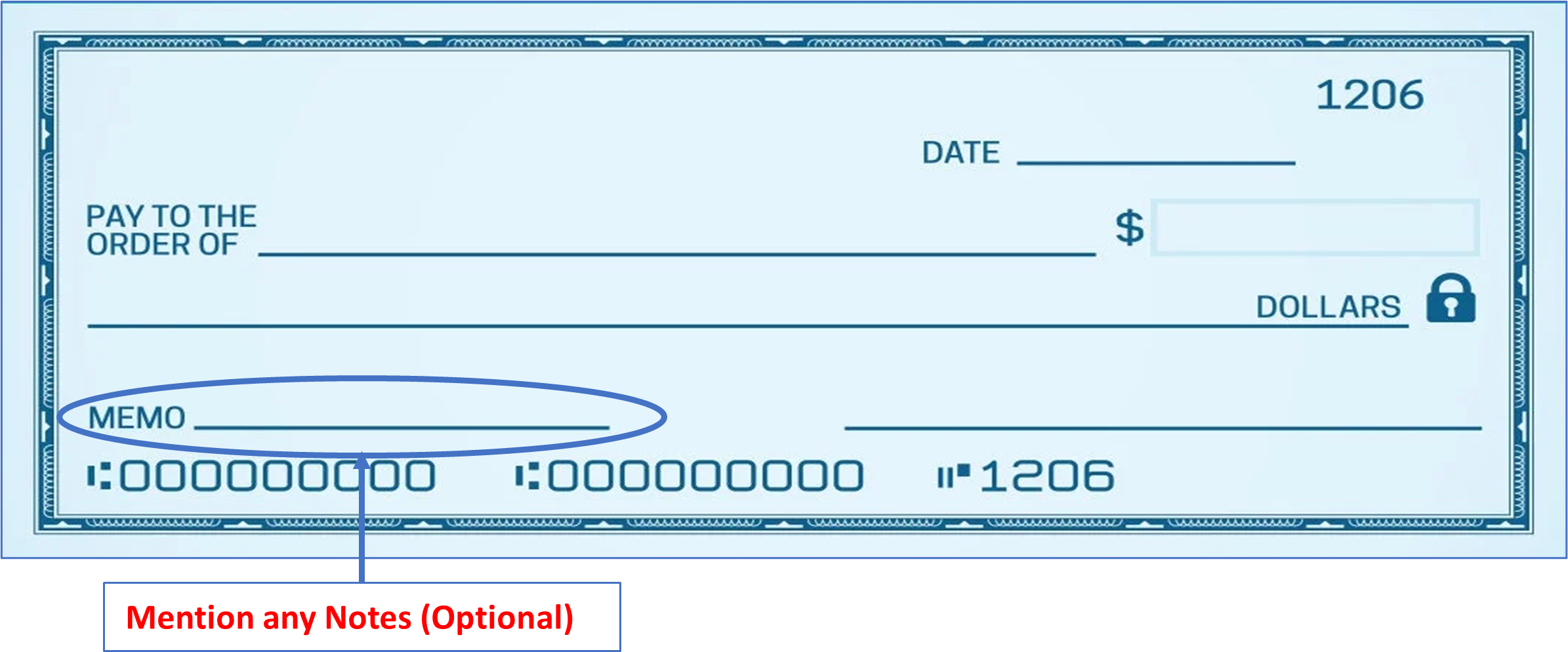

Step 5: Write a memo (optional)

Filling out the “Notes” line is optional, but it will help you know why you wrote the check. If you pay monthly utility bills or rent checks, you can write “Utility Bills” or “Monthly Rent” in the remarks column.

Step 6: Sign the check

Sign the bottom right line with the signature you used when you opened your checking account. This indicates to the bank that you have agreed to pay the specified amount to the correct recipient.

What are the different types of checks?

Even if you’ve never used a check before, you probably know what they are. But did you know that there are different types of checks? There are many types of checks that come from different financial providers and offer many kinds of useful features.

List of Different Types of Checks:

- Bank Checks

- Payroll Checks

- E-Checks or Electronic Checks

- Traveler’s Checks

- Personal Checks

- Money Orders

- Certified Checks

- Cashier Checks

- Commercial Check

- Business Checks

- Government Checks

- Tax Refund Checks

- Insurance Checks

- Out-of-State Checks

What is a bank check?

Bank checks are regular checks or traditional checks. They are provided through banks or credit unions or purchased from you. You can buy a book of bank checks that are usually linked to your checking account.

What is a payroll check?

Payroll checks are like paychecks. They are a type of check earned from payroll, and the department of the workplace that handles payment of workers’ earnings is a payroll check or paycheck. Salaries are typically paid on a regular basis, such as once a week, once a month, or once every two weeks. Employees can also opt for direct deposit, so your earnings are deposited directly into your bank account instead of receiving physical checks.

What are E-checks?

E-check stands for an electronic check. They are the digital version of checks. Check your bank account to see if it offers electronic check services. An electronic check is a type of bank draft that is electronically notarized and can be used for secure online payments.

What is a traveler’s check?

A traveler’s check is exactly what it sounds like. A traveler’s check is a type of prepaid check that you can use like cash when traveling from home. Traveler’s checks are usually insured in some way, making them safer than cash to carry while traveling.

What is a personal check?

A check from a personal bank account. These are the types of checks found in a personal checkbook. Personal checkbooks can be purchased from a bank or credit union.

What is a money order?

Money orders are a bit like prepaid checks. You can receive exchanges at agents. It works as a paper prepaid form of payment. Western Union is a popular currency exchange provider.

What is a certified check?

It is a kind of prepaid check. A regular check is not prepaid and is paid when the check payee deposits the presented check. A certified prepaid check is paid when the check issuer retrieves the check and prepays the amount.

What are cashier checks?

This is another kind of prepaid check. These checks are also written by the bank account holder and drawn up by the issuing bank. Your prepaid check has now been paid and paid to its intended recipient.

What is a commercial check?

If you are in business, you need a way to accept payments from your customers. Customers can pay by debit card, credit card, cash, or check. When a customer pays a company by check, the check is called a commercial check because the name on the check is the company name, not the person’s name.

What is a business check?

You can order these types of checks for your business, link them to your business bank account, and write checks on behalf of your business.

What is a government check?

A government check, as the name suggests, is a check issued by the government. This may include checks such as financial aid, government grants, social security checks, unemployment benefits, meal checks, and tax refunds.

What is a tax-refund check?

One government check that many taxpayers are familiar with is the tax refund check. It is given to eligible taxpayers for a tax refund. Tax refunds are sent during the tax season after the taxpayer files his/her tax return.

What is an insurance check?

An insurance check is drawn up and paid by an insurance company after something occurs that is covered by the insurance. For example, if you are involved in an accident and need your vehicle repaired, you may be eligible to receive payment from your insurance company to help pay for the repair of your vehicle.

What is an out-of-state check?

For out-of-state checks, it can be any check if the check writer is out-of-state. A check is an interstate check if the check issuer’s bank account does not exist in the state where the check was deposited. This can make checks difficult to use if the check provider is not working in its current state.

Summary

Before writing a check, make sure you have sufficient funds to cover the purchase and consider alternative payment methods such as wire transfers or debit card payments. You must enter the payment amount in both words and numbers, and carefully fill in other fields such as payee name, signatures, and memo lines. Recording details in your check register allows you to record more information than what appears on your bank statement, such as: To whom you paid and why.

FAQs: Frequently Asked Questions

How do I write out a check to myself?

You may wonder why we write out a check to ourselves. It is another way to withdraw cash from your bank account or transfer money between accounts. To do this, write your name on the recipient line. Writing a check to himself is one of his options, although there are more efficient ways to withdraw money from the bank.

Is it illegal to write a post-dated check?

In most cases, it’s legal to write a postdated check, but check your state’s laws for specific guidelines. A postdated(PD) check is a check with a future date. This can happen if someone sends the payment before the due date or if there are insufficient funds in the account when the check is issued.

Can you deposit a check at an ATM?

Some banks and credit unions allow you to deposit checks at their ATMs. If your bank allows it, find an approved ATM, enter your debit card and PIN, and follow the on-screen instructions to deposit your check. Check with your bank or credit union to see if they allow depositing checks at an ATM and if they have specific instructions on how to deposit a check.